One option for sending money to Cuba is via international bank transfer. This involves transferring funds from your bank account in one country to a bank account in Cuba. You will need to provide details of the recipient’s Cuban bank account. Transfers can take 3-5 business days to complete. Fees vary between banks but are typically a small percentage of the transfer amount, such as 1-3%. The transfer sum is subject to Cuban government regulations on receiving foreign funds. Recipients can then withdraw funds at their local bank branch in Cuban Convertible Pesos (CUC). This method allows you to transfer larger sums but takes more time than quick money transfer services.

What is the fastest way to send money to Cuba?

Considering factors like speed, convenience and cost, the quickest options for sending funds promptly to recipients in Cuba are typically money transfer services Western Union and MoneyGram. Both allow initiating transfers online or at one of their many global agent locations 24/7, with payouts available within hours at outlets across the island country. With Western Union, transfers of up to $200 can often be completed and paid out within 2-4 hours for a fee of around 8-10% plus $5 minimum. Similarly, MoneyGram provides transfers under $300 in 1-2 hours for total fees of approximately 7-8% and $5. International bank wires, while able to send larger sums, generally take 3-5 business days to clear between financial institutions. So if urgency is the priority, Western Union or MoneyGram are generally the most timely choices for sending money to Cuba.

Comparing money transfer services for sending to Cuba

The main options for sending money to Cuba – bank wires, Western Union and MoneyGram – each have their advantages depending on factors like transfer speed, cost of fees and flexibility of amounts. International bank wires are best for larger transfers but take longest. Western Union and MoneyGram allow very timely transfers, even though fees work out higher on lower amounts. Generally speaking, bank wires are optimal for over $500, while Western Union and MoneyGram are best for $50-$500 due to lower percentage fees on smaller transfers. It’s also worth checking exact payout locations and exchange rates applied as these can differ between services as well as over time. Overall, evaluating individual needs around urgency, cost and convenience is key to choosing the most suitable service.

Using PayPal to send money to Cuba

While PayPal is a very popular online payment system, it cannot currently be used to directly transfer funds to recipients in Cuba. This is because the US government prohibits digital and electronic financial services from being used to interact with Cuban institutions or nationals. PayPal is American-owned so cannot legally process payments going to Cuba. However, some users have found workarounds through third party intermediaries to exchange digital payments for cash that can eventually reach Cuban citizens. While these methods work, they are indirect and come with additional costs and delays versus mainstream money transfer options like bank wires and Western Union discussed above. For most users, direct options will provide smoother and faster money transfers to Cuba compliant with US rules.

Sending cash money to Cuba

Some people prefer sending physical cash funds to Cuba rather than electronic transfers. However, there are important limitations to consider with this approach. It is illegal for Americans to directly spend cash in Cuba or transport cash on their behalf without a license due to the US embargo. Cash can only be legally handed to a Cuban recipient during personaltrips of $10,000 or less per quarter. Upon returning, travelers must declare any cash at customs. Further, exchanging large amounts of foreign cash in Cuba is challenging and typically done at unfavorable black market exchange rates rather than official CUC/Cuban Peso rates. Overall, licensed money transfer services provide a much safer, traceable and cost-effective way to send funds versus cash which entails legal and practical complications.

Sending money by bank transfer to Cuba

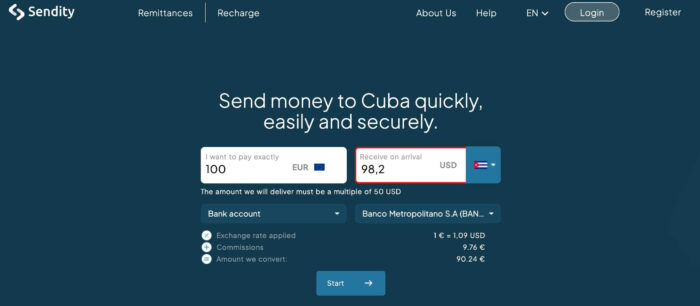

As mentioned earlier, international bank wire transfers allow sending larger sums to Cuba but require a few days for funds to clear. To initiate a wire, you’ll need routing/account details from the recipient’s Cuban bank. Popular national banks in Cuba include Banco Popular de Ahorro, Banco Metropolitano and Banco de Crédito y Comercio. Bank wires are officially capped at $2,000 per trimester by Cuban government rules. Fees depend on your originating bank but are often 1-3% with a $15-30 fee. Funds are then available in CUC at any branch. Recipients may face paperwork and account minimum balance requirements to receive wires. While not instant, bank wires are still a reliable option for regulated larger value transfers to Cuba when timeliness is not critical.

Mobile money transfers for sending money to Cuba

So far there are no mobile money services directly providing person-to-person transfers between foreign phones/wallets and Cuba due to restrictions. However, some apps allow initiating transfers from abroad that are later paid out in cash locally in Cuba. An example is AirTM, which permits users to convert digital currencies like Bitcoin received on their Cuban cellular account into cash at payout locations on the island. Recipients must have a Cuban mobile number registered to the app. While innovative, these types of transfers still face issues like volatility in crypto values, limited payout options in Cuba and additional conversion costs relative to traditional services. For most users, mainstream money transfer providers currently give the most seamless and cost-effective transfers until direct mobile integration with Cuba becomes available.